混合型個人養老年金定價與風險管理(英文版) | 如何做好生意 - 2024年11月

混合型個人養老年金定價與風險管理(英文版)

Hybrid pension plans offer employees the best features of both defned beneft and defned contribution plans。In this work,we consider the hybrid design offering a defned contribution beneft with a defned beneft guaranteed minimum underpin。This study applies the contingent claims approach to value the defned contribution beneft with a defned beneft guaranteed minimum underpin。The study shows that entry age,utility function parameters and the market price of risk each has a significant effect on the value of retirement benefits.

We also consider risk management for this defned beneft underpin pensionplan。Assuming fxed interest rates,and assuming that salaries can be treated as a tradable asset,contribubion rates are develop tor the Entry Age Normal(EAN),Pro jected Unit Credit(PUC),and Traditional Unit Credit(TUC)funding methods.For the EAN,the contribution rates are constant throughont the service period。However,the hedge parameters for this method are not tradable。For the accruals method,the individual contribution rates are not constant。For both the PUC and TUC,a delta hedge strategy is derived and explained.

The analysis is extended to relax the tradable assumption for salaries,using the inflation as a partial hedge。Finally,methods for incorporating volatility reducing and risk management are consddered.

Chapter 1 Introduction

Chapter 2 Current Pension systems and Pension Fund Risk Management

2.1 Defned Beneft Plan

2.2 Funding Methods for DB Plans

2.3 Defned Contribution Plan

2.4 Pension Reform

2.5 Hybrid Pension Plans

Chapter 3 The Valuation of a DB Underpin Pension

3.1 Introduction

3.2 The Model and Assumptions

3.3 Numerical Techniques

3.4 Results

3.5 Scenario Test

Chapter 4 Funding Strategies with Two Traded Assets

4.1 Introduction to Risk Management

4.2 Assumptions

4.3 Margrabe Option

4.4 Strategy 1:EAN Cost Method

4.5 Strategy2:EAN Cost Method

4.6 Strategy3:PUC Cost Method

4.7 Strategy4:TUC Cost Method

4.8 Summary

Chapter 5 Numerical Examples of Hedging Costs

5.1 Introduction

5.2 Numerical Simulation

5.3 Hedging Costs

5.4 Scenario Tests

Chapter 6 Salary,Infation,and Equity Returns

6.1 Ob jectives

6.2 Data Analysis

6.3 Selection of Hedging Assets

Chapter 7 Hedging Costs

7.1 Introduction

7.2 The Model for Salary and Infation

7.3 Numerical Results

Chapter 8 Hedging with Stochastic Interest Rates

8.1 Introduction

8.2 Afne Term Structures

8.3 Estimated Annuity Rates

8.4 Numerical Results for Strategy 3

8.5 Numerical Results for Strategy 4

Chapter 9 Costs Control

9.1 Introduction

9.2 Unstable Hedging Cash Flows and Hedging Cost Spikes

9.3 Salary Growth Rate Control

9.4 Arithmetic Average on Salaries

9.5 Other Cost Control Methods

Chapter 10 Comments and Further Work

10.1 Salary Growth Rate

10.2 Other Risk Management Approaches

10.3 Costs Control

Bibliography

零失誤!日文商用e-mail即貼即...

零失誤!日文商用e-mail即貼即... 全球品牌智財管理案例研究

全球品牌智財管理案例研究 最強保險搭配法則:只要活用「社會保...

最強保險搭配法則:只要活用「社會保... 大師級Excel取巧工作術:一秒搞...

大師級Excel取巧工作術:一秒搞... 品牌新思維:掌握趨勢、突破挑戰的六...

品牌新思維:掌握趨勢、突破挑戰的六... 超元氣!東京+近郊精華:橫跨東京都...

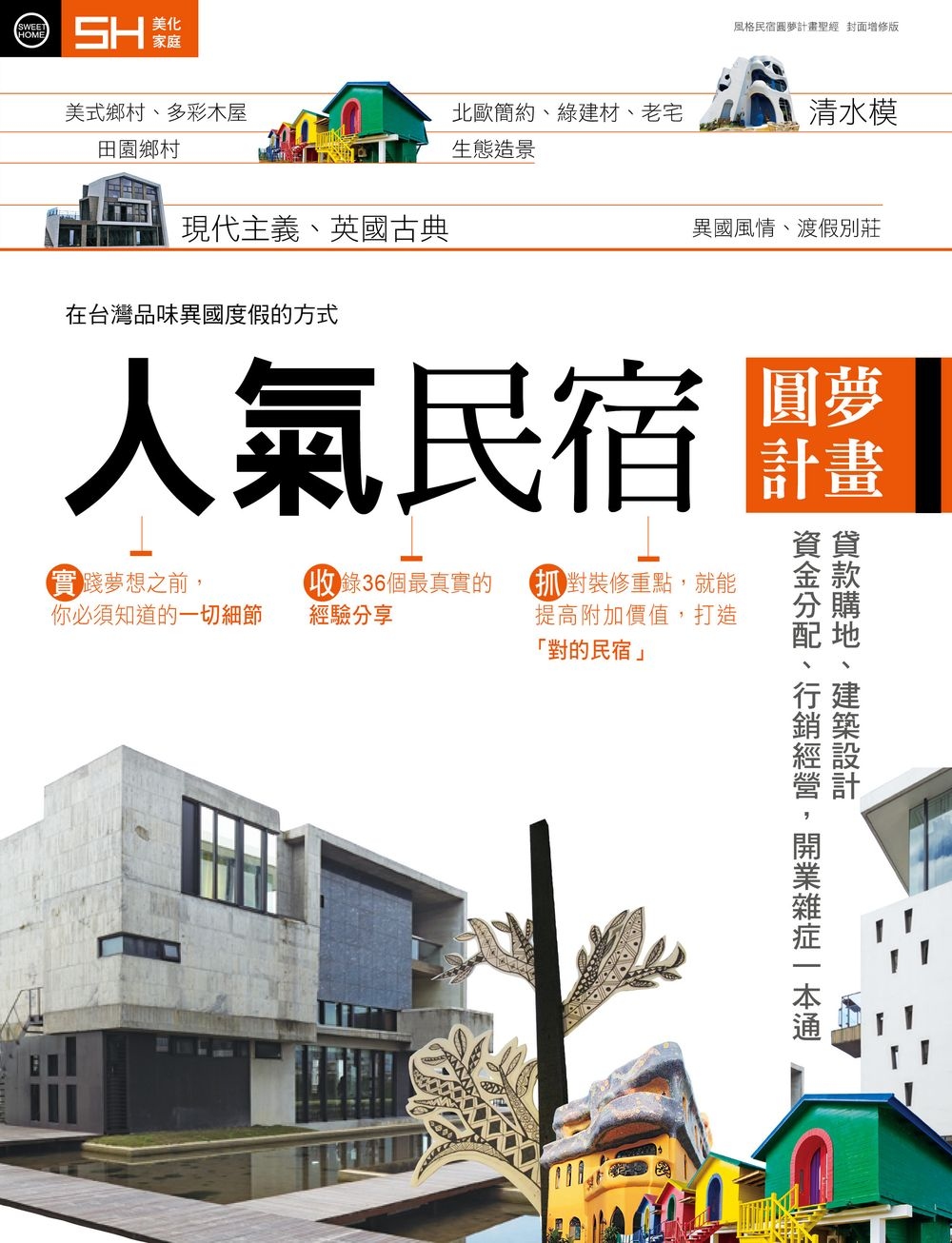

超元氣!東京+近郊精華:橫跨東京都... 人氣民宿圓夢計畫:貸款購地、建築設...

人氣民宿圓夢計畫:貸款購地、建築設... 別讓黑心裝潢坑你錢:裝修絕不吃虧教戰手冊

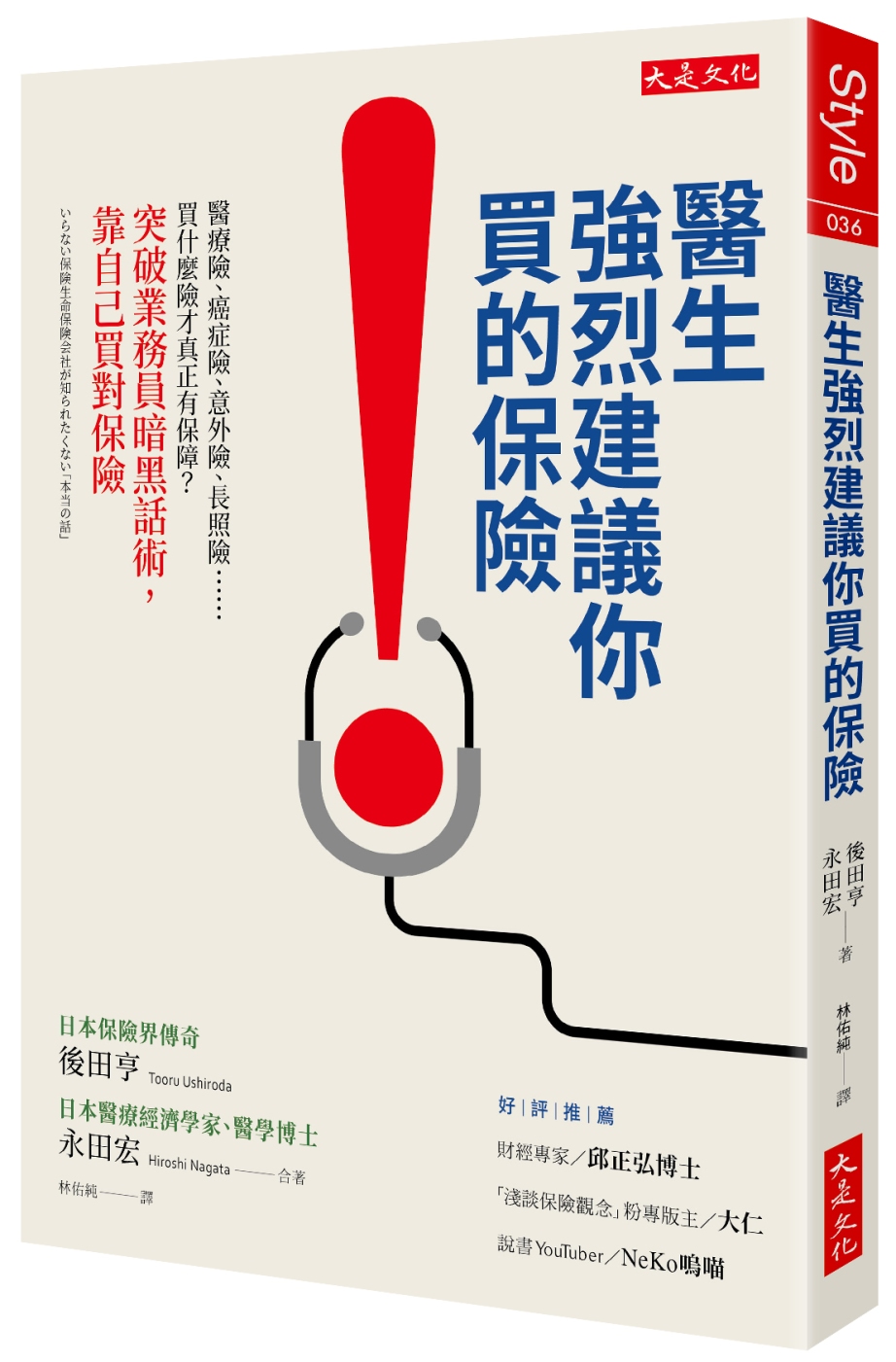

別讓黑心裝潢坑你錢:裝修絕不吃虧教戰手冊 醫生強烈建議你買的保險:醫療險、癌...

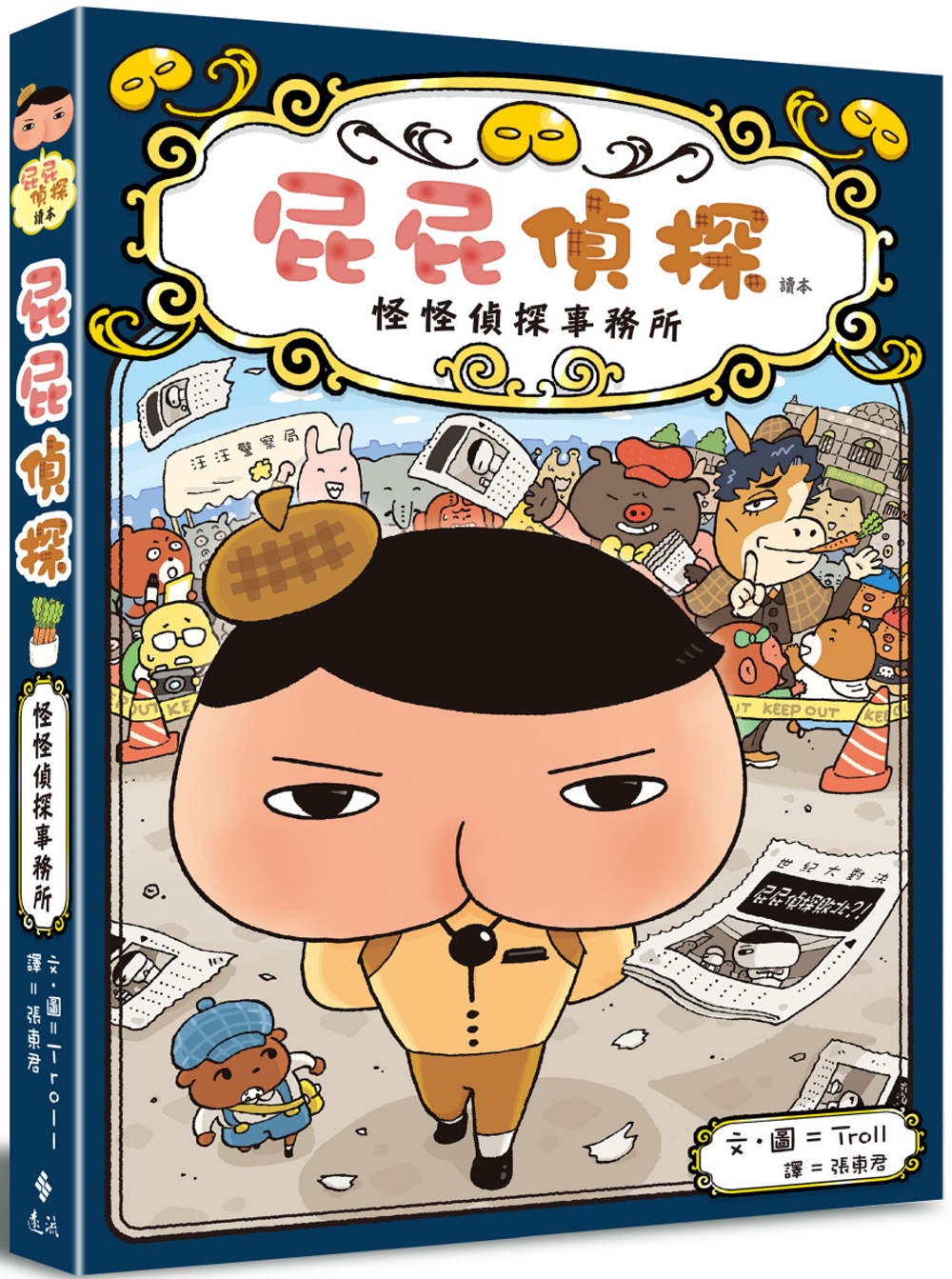

醫生強烈建議你買的保險:醫療險、癌... 屁屁偵探讀本 怪怪偵探事務所

屁屁偵探讀本 怪怪偵探事務所